All Categories

Featured

Table of Contents

Several annuities bill a penalty if you withdraw money prior to the payment stage. This penalty, called a surrender charge, is generally highest in the very early years of the annuity - Tax-deferred annuities. The cost is frequently a portion of the taken out money, and usually begins at around 10% and drops yearly up until the surrender period mores than

Annuities have various other fees called tons or commissions. Occasionally, these costs can be as high as 2% of an annuity's worth. Include these costs when approximating the cost to purchase an annuity and the amount you will certainly gain from it. If an annuity is an excellent alternative for you, utilize these ideas to help you shop: Premiums and benefits vary from business to company, so speak to more than one business and compare.

Fixed Indexed Annuities

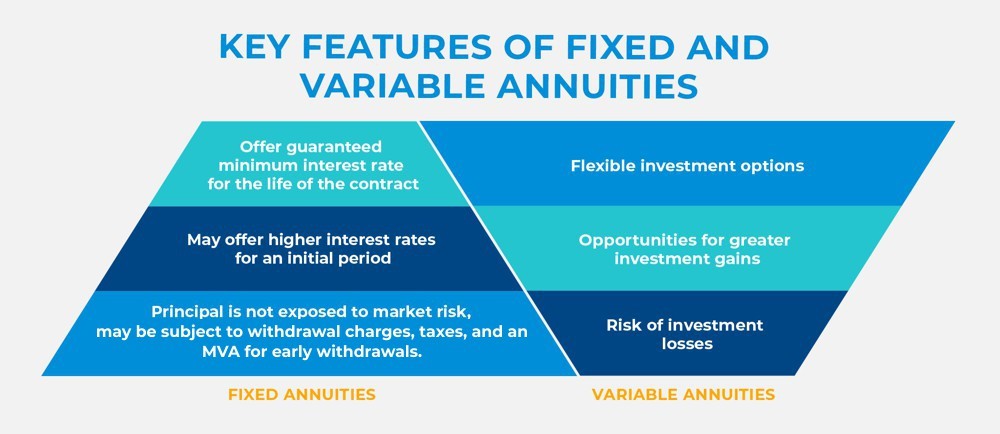

Variable annuities have the potential for greater incomes, however there's even more threat that you'll shed cash. Be cautious concerning putting all your assets right into an annuity.

Annuities sold in Texas should have a 20-day free-look period. Replacement annuities have a 30-day free-look period.

What should I know before buying an Lifetime Payout Annuities?

The quantity of any surrender costs. Whether you'll shed any type of incentive rate of interest or features if you quit your annuity. The guaranteed interest rates of both your annuity and the one you're considering replacing it with. Just how much cash you'll need to begin the brand-new annuity. The lots or compensations for the brand-new annuity.

Make certain any type of representative or firm you're considering acquiring from is licensed and solvent (Variable annuities). To confirm the Texas license status of a representative or company, call our Customer service at 800-252-3439. You can likewise utilize the Business Lookup attribute to learn a business's monetary score from an independent rating company

Morningstar has no responsibility for the collection or upkeep of the Index or its performance, and no obligation to any individual for its usage. The Morningstar name and logo are registered marks of Morningstar. Morningstar does not guarantee the precision, efficiency or timeliness of the US Returns Growth Index or any type of data included in it and expressly disclaims any kind of service warranties connected with it.

Additionally, Bankers Life and Casualty Company as company of the Bankers Annuity might for itself carry out transaction(s) with Barclays in or connecting to the Index about the Bankers Annuity - Income protection annuities. Purchasers buy the Bankers Annuity from Bankers Life and Casualty Firm and buyers neither acquire any type of rate of interest in the Index nor become part of any kind of partnership of any type of kind whatsoever with Barclays upon buying of the Bankers Annuity

What are the benefits of having an Annuity Withdrawal Options?

Barclays shall not be responsible in any means to the purchasers or to other third events in respect of the use or accuracy of the Index or any type of information consisted of therein. **The premium perk rate relevant per premium down payment may vary but will be at least 1 - Tax-deferred annuities.00%. Qualified costs will get a bonus

Withdrawals from the annuity in excess of the free partial withdrawal, or various other distributions, might lead to a section of the premium perk that has actually not vested being waived. 2 Each costs will have its own premium bonus and withdrawal fee period and withdrawal charges. Premiums deposited on or after the anniversary adhering to the Annuitant's 85th birthday will not receive a premium perk and will not go through withdrawal charges.

This score is their analysis of our family member monetary toughness and capability to fulfill legal commitments. This is an annuity insurance policy solicitation. An insurance agent/producer may contact you.

They are not backed by the broker-dealer and/or insurance coverage firm offering the plan, or any affiliates of those entities other than the providing firm affiliates, and none makes any representations or assurances regarding the claims-paying ability of the provider. These items and its features are subject to state availability and may vary by state.

Annuity Investment

and have actually been accredited for usage by Bankers Life and Casualty Business. Bankers Life annuities are not sponsored, supported, offered or promoted by Standard & Poor's and Requirement & Poor's makes no representation regarding the sensibility of purchasing any type of annuity. Annuities are items of the insurance policy industry and are not guaranteed by the FDIC or any kind of various other government company.

Does not constitute financial investment recommendations or a suggestion. Bankers Life is the marketing brand name of Bankers Life and Casualty Business, Medicare Supplement insurance policy plans offered by Washington National Insurance coverage Business and pick policies marketed in New York by Bankers Conseco Life Insurance Policy Firm (BCLIC). BCLIC is accredited to offer insurance coverage in New York.

It's talking to your parents regarding annuities and monetary recommendations for seniors, and it's kind of including that hard discussion as they cognitively start shedding it a little bit. It's a tough topic, yet we're going to have a little bit of enjoyable because I can't not have fun.

My father passed away a couple of years ago, and my mama is doing rather well. We established up her bill paying so that all the expenses we can pay are done digitally, and she does not have to write checks.

Long-term Care Annuities

I establish my mommy up on Uber. I truly don't want my mama driving. She's 81. I do not feel comfy with that, especially during the night, due to the fact that she does not have wonderful vision. And I stated, "Let's simply established you up for Uber." Of course, she does not assume she can afford it.

However when we speak about society's aging, this is an interesting time and an excellent tale, and this is what drove me to do this blog. A customer of mine called up and stated the adhering to, and it was a hammer shot to me since I really did not really consider it until he claimed it.

And I said to him, I said, "Simply stop - Retirement income from annuities. And I applauded him for taking that aggressive action because that's hard.

What types of Immediate Annuities are available?

We're all going to have to do that at some point unless our Lear jet strikes the mountain? The factor is, he was doing it proactively for himself. And possibly you're believing that available. Possibly that's what you're assuming: hello, we're obtaining up in years, and our moms and dads or my parents or whoever shed some cognitive ability to make those choices.

Table of Contents

Latest Posts

Decoding Fixed Vs Variable Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Pros and Cons of Choosing Between Fixed Annuity And Variable Annuity Why

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Index Annuity Vs Variable Annuities Breaking Down the Basics of Variable Annuities Vs Fixed Annuities Pros and Cons of I

Decoding Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Vs Variable Annuities Pros and Cons of Choosing Between Fixed Annuity And Variable A

More

Latest Posts